When other financial aid sources (such as grants or scholarships) don’t cover the full cost of your education, unsubsidized loans can bridge the gap. This kind of loan can offer a safety net you need to account for unexpected expenses or increase in tuition cost.

Unlike some private loans, unsubsidized federal loans don’t require a specific income level or credit score. Also, taking out an unsubsidized loan and making timely payments can help students establish a positive credit history.

Similarly, there are many acute benefits of an unsubsidized loan. That’s what you’re going to explore in this article beyond eligibility, borrowing limit, application process, and repayment options. But first, let’s understand the basics.

What Are Federal Student Loans?

Federal student loans are financial aid provided by the U.S. government to help students pay for their college education. Here are the key points:

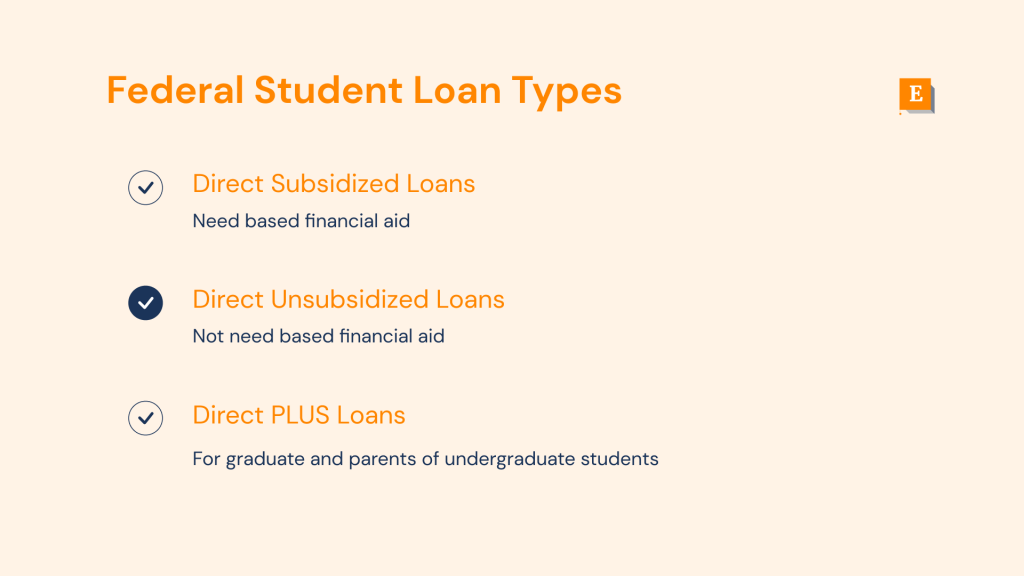

Types of Federal Student Loans:

- Direct Subsidized Loans: These loans are based on financial need. The government pays the interest while you’re in school and during certain other periods.

- Direct Unsubsidized Loans: These loans are not need-based, and you’re responsible for paying the interest from the start.

- PLUS Loans: These are for graduate students or parents of dependent undergraduate students. They have higher interest rates and require a credit check.

Related: What is a Parent PLUS Loan? Procedure, Benefits, Timelines, And More

Federal student loans typically have fixed interest rates, which means the rate remains the same throughout the life of the loan. The interest rates are set by the government and are generally lower than private loans.

You start repaying federal student loans after you graduate, leave school, or drop below half-time enrollment. There are various repayment plans available, including income-driven plans that adjust your payments based on your income.

To access federal student loans, you need to complete the Free Application for Federal Student Aid (FAFSA). The FAFSA determines your eligibility for federal aid, including grants, work-study, and loans.

What Is an Unsubsidized Loan?

Unsubsidized loans are low-interest federal student loans available to both undergraduates and graduate students. Unlike subsidized loans, they don’t depend on financial need. Anyone can apply for them.

Subsidized vs Unsubsidized Loans

With unsubsidized loans, interest starts accumulating right after you receive the loan. This means you’ll owe more over time. In contrast, subsidized loans don’t accrue interest while you’re in school or during the grace period after graduation or deferment. Here’s a more detailed comparison between the both:

| Aspect | Direct Subsidized Loans | Direct Unsubsidized Loans |

| Interest | No interest while enrolled in school or during the six-month grace period | Interest starts accumulating from the date of the first loan disbursement |

| Interest Payment | Government pays the interest during certain periods | Borrower is responsible for all interest costs |

| Eligibility | Based on financial need | Not based on financial need and so it’s available to both undergraduate and graduate borrowers |

| Borrowing Limits | Lower borrowing limits | Higher borrowing limits |

How Much Can You Borrow From Unsubsidized Loans

Your school determines the amount you can borrow from federal student loans based on your cost of attendance and other financial aid you receive. There are limits on the amount of unsubsidized loans you can receive each academic year.

These limits vary depending on your year in school and whether you are a dependent or independent student. If you are a dependent student whose parents are not eligible for a Direct PLUS Loan, you may be able to receive additional funds.

But please do remember that the actual loan amount you are eligible to receive may be less than the annual loan limit. So, all-in-all, here’s the overview of the actual loan funds you can receive.

| Year or Study | Dependent Students (except students whose parents are unable to obtain PLUS Loans) | Independent Students (and dependent undergraduate students whose parents are unable to obtain PLUS Loans) |

| First-Year Undergraduate | $5,500 | $9,500 |

| Second-Year Undergraduate | $6,500 | $10,500 |

| Third Year and Beyond | $7,500 | $12,500 |

| Graduate or Professional Studies | Not applicable since all graduate and professional degree students are considered independent | $20,500 |

How to Apply for an Unsubsidized Loan

To apply for a Direct Unsubsidized Loan, follow these steps:

Complete the Free Application for Federal Student Aid (FAFSA):

Start by filling out the FAFSA form at StudentAid.gov. This application is essential for determining your eligibility for federal financial aid, including unsubsidized loans.

Receive Your Financial Aid Award Letter:

After submitting the FAFSA, your school’s financial aid office will send you a financial aid award letter. This letter outlines the types and amounts of aid you qualify for, including any unsubsidized loans.

Contact Your Financial Aid Office:

Reach out to your school’s financial aid office to accept the financial aid offered, including the unsubsidized loan. They will guide you through the process and provide further instructions.

Sign Associated Paperwork:

Once you’ve accepted the loan, sign any necessary paperwork, such as the master promissory note (MPN). The MPN is a legal document that outlines the terms and conditions of your loan.

Repayment And Interest

The interest rate for unsubsidized loans disbursed on or after July 1, 2023 and before July 1, 2024 is 7.05%. And it’s a fixed interest rate so it won’t change for the life of your loan.

| NOTE: There is a small origination fee of 1.059% from each loan disbursement. |

All unsubsidized loan repayments have to be made directly to your loan servicer. Your loan servicer will manage your loan account and all your queries. You will be set on a standard repayment plan unless you request your loan servicer to use a different repayment plan that’s more viable to you.

You can also choose to repay a little extra each month or before your due date to reduce your total interest payout. Your loan servicer can help you strategize the most optimum way to repay your loan. Discuss your options with them.

To Sum Up

Unsubsidized loans provide greater flexibility and accessibility, making them a valuable resource for students pursuing higher education. Remember to consider your individual financial situation and educational needs when deciding between subsidized and unsubsidized loans.

Frequently Asked Questions (FAQs)

The Direct Subsidized Loan provides interest subsidy. Since these are based on financial need (as determined by the FAFSA), you won’t have to pay the interest on the subsidized loan while you’re enrolled in school. But you soon have to start paying back the borrowed money along with the interest that starts to accrue from that moment you leave school.

No, the FAFSA is not a loan or any type of other financial instrument. It’s an application form that is used to determine eligibility and apply for financial aid (grants, work-study funds, and scholarships) and federal student loans.

The amount of need-based financial aid that you can receive is calculated by subtracting your expected family contribution (EFC) from your cost of attendance (COA). And to calculate the amount of non-need-based financial aid you can receive, subtract any financial aid you have already received with your COA.

Yes, most federal student loans accrue interest from the moment the amount gets disbursed except the Direct Subsidized Loan, in which the government pays the interest while you’re enrolled in school.

Yes, unsubsidized loans accrue interest from the day of disbursement. Unlike subsidized loans, you need to pay back the entire borrowed amount along with the interest that gets accumulated (during your time at school and beyond).