What is a Financial Aid Award Letter?

Simply put, a financial aid award letter–sometimes called a financial aid offer–is the document from the schools you have applied to that outlines the financial aid and costs for attending that school. Once you have submitted your FAFSA (Free Application For Federal Student Aid) and gotten accepted to a college, they will send you this letter. The financial aid award will tell you how much scholarship and grant money you will likely get when you enroll in their college. It will also usually tell you the amount of recommended student loans, work-study, and parental loans recommended. But these scholarship award letters can be hard to read, and often, they differ from one college to the next, making it extra hard to figure out how much college will cost.

Your Award Letter Arrived–Now What?

Now you need to think carefully about how much you will need to pay for your college education. You need to consider both the amount you or your family will need to pay right now and how you will repay any loans you take out for your college education.

The first step is understanding financial aid and the types of assistance you will see on your award letter. See below for the main terms and types of support you will see on your scholarship award letter; knowing the types of financial aid will help you in understanding financial aid offered by different colleges.

Guide to the Terms in Your Financial Aid Award Letter

FAFSA meaning: Free Application for Federal Student Aid.

FAFSA is the form you fill out online to help colleges determine what aid you qualify for, including federal, state, and grant aid. Schools also use this information to decide how much institutional support they will give you. Filling out your FAFSA is something you should do as soon as you can when applying to colleges.

COA: Cost of Attendance.

The COA is the total cost of attending the school, and it should include tuition, fees, lodging and food, books and supplies, transportation, and any other expenses you will likely encounter when you attend school. The COA may have two options for your room and board–one for if you live on campus in the dorms and one for if you live off campus. Your COA could also be lower if you choose to live at home and commute to college classes.

EFC: Expected Family Contribution

Based on the information you put on your FAFSA, this is the amount that your family will need to pay for your college expenses.

Pell Grant:

Grant from the federal government for students with high financial needBecause a Pell Grant is a grant, not a loan, you do not have to pay this back.

State Grant:

Like the Pell Grant, this is money the state will put towards your education. These vary by state, and not all states offer them.

Institutional Grant:

Institutional grants are money coming from the college to help you afford to go to the school. It is effectively a discount the school provides based on your financial need.

Merit Scholarship:

The college or university may give merit scholarships based on your academic, athletic, or artistic achievements. Merit scholarships don’t consider your financial need but instead reflect your test scores, grades, or talents in athletic or extracurricular activities.

Work-Study:

If you checked the box on your FAFSA for work-study and are eligible, you can look for jobs on your campus that will pay you minimum wage. You are paid only for the hours you actually work, so to get the amount you listed, you must work those hours. The pay from work-study is useful as spending money during the year, as it is only available once you have worked, so you can’t use it to pay upfront costs like tuition.

Student Loans: Federal loans that require no credit check

Subsidized Student Loan: A loan in the student’s name that you must pay back. The federal government pays the interest on the loan during your college enrollment.

Unsubsidized Student Loan: A loan in the student’s name that you must repay. The interest on the loan accrues from the start of the loan.

Parent Plus Loan:

Your parents can take out a Parent Plus loan, and they would be responsible for paying them back. When your parents apply, a credit check is required, and the interest rate is usually higher than on student loans.

How to Read Financial Aid Award Letters

Because you have filled out your FAFSA, meaning that each college you applied to received the same financial data, that doesn’t mean that they will interpret your financial need the same way. A college with more expensive tuition may give you more aid, making it cheaper to attend than a less expensive school. Understanding financial aid awards from each college means reading your offers carefully and doing some simple math. Also, look at the financial aid award letter sample below to help orient yourself.

Step 1: Find the Cost of Attendance (COA)

Some financial aid award letters will give you the overall cost of attending, while others may list the tuition and fees, leaving out your living expenses like rent and food. Look for that total number; if it is not there, see if other information within your acceptance packet or on the school website lists the missing items. Remember to add in lodging (dorm or off-campus rent), food, transportation costs, health insurance, utilities like your cell phone bill and other necessary monthly expenses, books, computers, school supplies, clothing, and any furnishings. Include everything you will need for a year in school. Once you have the COA, you can start to see how much of your costs are covered by your financial aid package from the school.

Step 2: Figure Out the Financial Aid You Will Not Have to Pay Back

The grants and scholarships you receive are the most valuable part of your aid package, as you will not have to pay these back. They will go straight towards paying for your college education, and you won’t need to ever think about it again. Include state grants, Federal Pell Grant, any institutional grant from the school, merit scholarship, and any other scholarship or award.

Step 3: Total Up the Loans on the Award Letter

Add up the student loans (subsidized and unsubsidized) and parent plus loans recommended on the financial aid award letter. It is essential to know how much you may owe when you graduate.

Note: Carefully consider how much you decide to borrow for your education. You don’t have to take out the maximum suggested loan, so see how to minimize your borrowing. For example, if your student loans total $8,000 each year, and you go to four years of school, you will end up with a $32,000 bill at the end of your education.

Step 4: Add the Total Financial Aid and Subtract from the COA

Add your total grants and scholarships to your suggested loans. If you are eligible for and plan to do work-study, add that number to the total. Take this total financial aid amount and subtract it from the total Cost of Attendance. The number you have left is the money you or your family will need to pay upfront for this year of school.

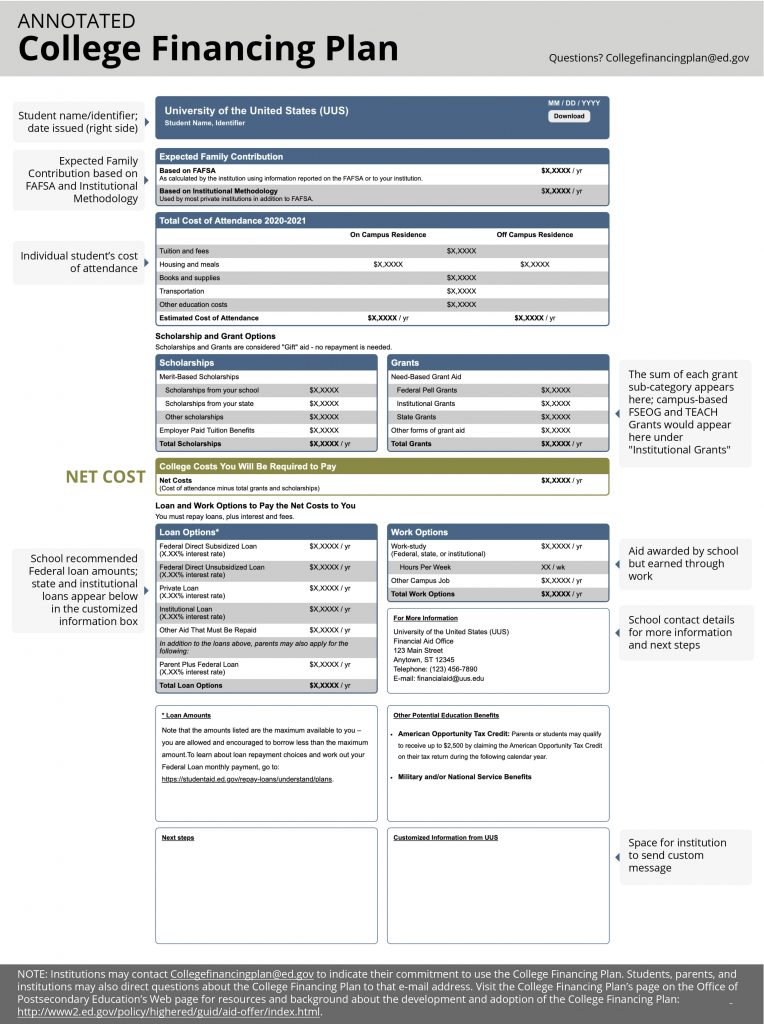

Financial Aid Award Letter Sample

Below is an annotated award letter sample from a template suggested by the U.S. Department of Education. Many schools use their own format, so you can see if the colleges you have applied to have a financial aid award letter example on their website.

Takeaways

- Your financial aid award letter gives you the amounts of each type of financial aid offered if you enroll in the school.

- Each school may have a different format for the scholarship award letter, making it confusing to read. Take the time to learn how to read financial aid award letters to compare offers.

- You need to read the letter from each school carefully to understand what aid you will need to pay back later (loans) and what money you will not owe when you graduate (grants and scholarships.)

Frequently Asked Questions

It is the letter sent to you by the college or colleges you have applied to, listing the amounts and different types of financial aid available to you to attend the school.

FAFSA is short for Free Application for Federal Student Aid, and it is a form you fill out online so that you can receive student financial aid from the federal government, state government, and the schools you have applied to. So start your quest to pay for college by filling out the FAFSA as early as possible.

A financial aid gap is the difference between the financial need you and your family have for you to attend college and the financial aid available to you. It represents an unmet need and a gap between what you can afford and the college’s cost.