Key Takeaways

- Financial aid for college students is often based on demonstrated financial need.

- While merit-based aid is awarded for specific achievements, need-based financial aid considers students’ economic circumstances to help them more easily attend college.

- Knowing what need-based financial aid is can help you identify ways to make your education more affordable.

College is a significant financial commitment. Before enrolling, it’s a good idea to explore all the financial aid options available to you so that you don’t miss out on ways to make your higher education more affordable. In this context, it’s worth taking the time to understand need-based financial aid and how to maximize the amount of aid you receive.

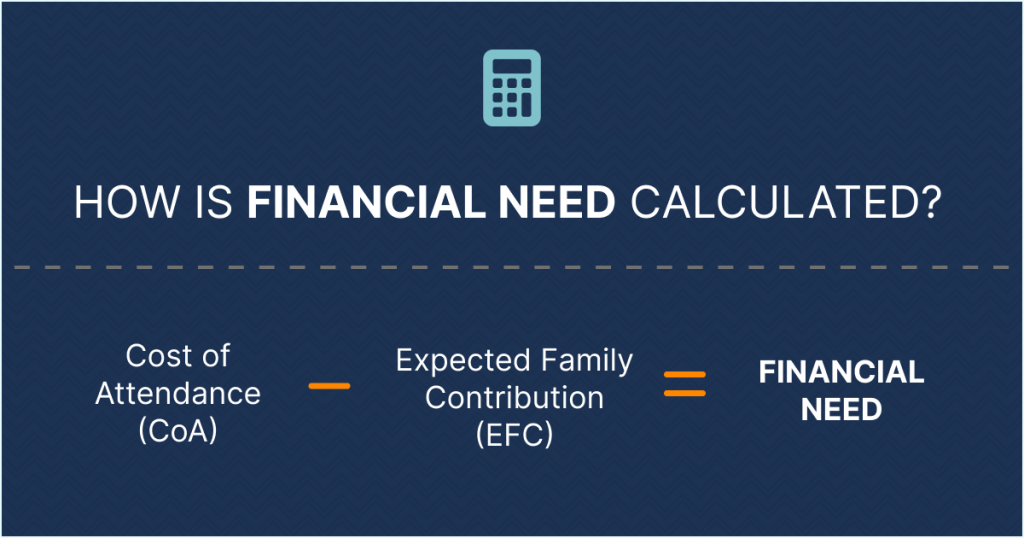

How is Financial Aid Calculated?

Before we cover the specifics of need-based financial aid, it’d be helpful to understand how financial aid is calculated in the first place. Financial aid is determined based on several factors, including the Cost of Attendance (CoA) for your desired colleges, your Expected Family Contribution (EFC), and your available financial resources. The cost of attendance typically includes tuition, fees, room and board, books, and personal expenses. The EFC is calculated through the Free Application for Federal Student Aid (FAFSA), which assesses your family’s financial situation. Colleges may use different formulas to determine your financial aid package (i.e., the amount of aid for which you’re considered eligible). Financial aid is calculated for each academic year, and can change with your CoA and EFC amounts.

The official Federal Student Aid Estimator is a great tool to help you estimate how much federal student aid you may be eligible to receive.

How is Financial Need Defined?

Simply put, financial need is the difference between your Cost of Attendance (CoA) and your Expected Family Contribution (EFC), as defined by studentaid.gov. While your EFC won’t change based on the school you attend, your CoA will vary with each school you apply to. This means that your financial need amount will likely be lower for community college, and higher for private schools.

What is Need-Based Financial Aid?

Need-based financial aid is a form of aid that is specifically designed to support students who demonstrate financial need by covering costs associated with their higher education. It is a valuable resource for students who may not have exceptional qualifications, but require financial support to afford college education.

How is Need-Based Financial Aid Determined?

Need-based financial aid is determined based on demonstrated financial need. As mentioned earlier, financial need is calculated as the difference between students’ CoA and EFC. Colleges and universities use this information on your FAFSA to identify your financial need. Institutions aren’t obligated to satisfy every student’s financial need entirely, so most need-based aid typically covers a portion of their total college expenses. That being said, in cases where the financial need is dire, some students may be eligible for aid that covers their total cost of attending college.

Different institutions may have different formulae for calculating the amount of aid for which a student is eligible. Usually, colleges and universities that receive larger endowments, alumni donations, and similar funds offer more need-based awards to eligible students. Before applying, take some time to research all the financial aid options offered. And don’t hesitate to reach out to the financial aid offices of your desired colleges.

Types of Need-Based Financial Aid

Need-based financial aid comes in many forms, offered by different entities. Some common types of need-based financial aid include:

Institutional Aid

Colleges and universities may offer their own need-based scholarships and grants to students who demonstrate financial need as determined by the FAFSA.

Subsidized Loans

Federal student loans, such as Direct Subsidized Loans, are available to students with financial need. These loans have more favorable terms, including interest subsidies while the student is in school.

Work-Study Programs

Federal Work-Study provides part-time employment opportunities for eligible students, allowing them to earn money to cover educational expenses. The program encourages community service work, work related to the student’s studies, or other jobs on or off-campus that will help with your finances.

Federal and State Grants

The federal and many state governments offer need-based grants to residents pursuing higher education within their state. The eligibility requirements vary by state, but all require you to fill out your FAFSA according to your state deadline. The Federal Government offers several need-based grants, like the Pell Grant, which helps thousands pay for college each year.

Private Scholarships

Some private organizations and foundations provide need-based scholarships to students facing financial hardship.

With need-based financial aid, it’s crucial to fill out the FAFSA accurately and submit it by the required deadlines to ensure you are considered for the full range of need-based financial aid opportunities available to you. The terms of need-based aid can differ between institutions and states, so research and proactive application are super important.

Understanding Need-Based Financial Aid

| Need-Based Financial Aid | |

| Eligibility Criteria | Usually awarded based on demonstrated financial need, considering factors like family income, assets, expenses, EFC, and CoA |

| Aim | Provides financial support to students who may not have outstanding qualifications but require assistance to afford education (i.e., for financial need) |

| Application Requirements | Requires submission of financial information through forms like the FAFSA (Free Application for Federal Student Aid). |

| Sources | Provided by federal and state governments, colleges, universities, and some private organizations. |

| Competition | Availability depends on financial need, and eligibility is determined by the cost of attendance and the EFC. |

| Maximizing Aid | Strategies include early FAFSA submission, meeting deadlines, and actively seeking available resources. |

Need-based financial aid can be the answer you’re searching for if college funding is troubling you. Many who qualify for need-based aid, but aren’t aware of it, miss out on securing financial assistance that can prove immensely helpful. Here are a few aspects that can help you better understand need-based financial aid and how it differs from merit-based aid:

Eligibility Criteria

In determining eligibility for need-based aid, an individual’s financial circumstances take center stage, with careful consideration given to factors such as family income and expenses. This evaluative process ensures that students demonstrating a legitimate need for financial assistance are identified and deemed eligible for the support they require. This contrasts with merit-based aid, which primarily considers academic achievements and accomplishments rather than financial need.

Aim

The overarching aim of need-based aid is to bridge the financial gap for students facing challenges in affording higher education. By specifically targeting those with demonstrated financial need, this form of aid strives to make educational opportunities accessible to a more diverse range of individuals, irrespective of their economic background. In contrast, merit-based aid is awarded based on a student’s exceptional academic or extracurricular achievements, regardless of their financial circumstances.

Application Requirements

Need-based aid often relies on the comprehensive Free Application for Federal Student Aid (FAFSA) to determine students’ financial need. This intricate process usually involves a thorough examination of various financial factors, providing a holistic view that aids in the fair and accurate distribution of financial assistance. On the other hand, merit-based aid may require additional documents such as letters of recommendation, essays, or proof of specific achievements, focusing more on academic or extracurricular merit.

Sources

Drawing from a variety of channels, need-based aid is usually sourced from federal and state governments, as well as colleges and universities. These institutions allocate funds based on students’ distinct financial needs, ensuring a multi-faceted approach to providing necessary financial assistance. This differs from merit-based aid, which is typically funded by private organizations, academic institutions, or specific scholarship programs aiming to reward exceptional achievements.

Competition

The eligibility for need-based aid is shaped by the level of financial need. As need-based aid is designed to address specific financial circumstances, there is little “competition” for those with genuine financial need. Many forms of need-based aid are awarded on a first-come, first-served basis. So, those with greater financial need who fill out and submit the FAFSA early are more likely to secure aid. Merit-based aid, on the other hand, is often highly competitive, and achievements are assessed to award deserving students.

Maximizing Aid

To achieve the maximum benefit from need-based aid, a few strategic steps can help. Some of these are: the early submission of the FAFSA, consistent adherence to deadlines, and an active pursuit of available resources. By adopting a proactive approach throughout the application process, students can position themselves to access the fullest extent of financial aid available to them. With merit-based awards, on the other hand, maximizing aid often involves showcasing exceptional accomplishments and meeting specific merit-based criteria.

How Can Merit-Based Awards Affect Need-Based Financial Aid?

In some cases, receiving merit-based awards can impact the amount of need-based financial aid offered. When a student is awarded a significant merit-based award, it may change their financial aid package, including need-based aid.

However, the extent to which merit awards affect need-based financial aid varies depending on each college’s financial aid policies. Some institutions have a “stacking” approach, where they may reduce need-based aid when a student receives a merit scholarship. This is done to ensure that the total aid does not exceed the cost of attendance. Others maintain a “replacement” policy, where merit scholarships do not reduce need-based aid, ensuring that students still receive the full amount of financial assistance they qualify for.

To fully understand how your package may be affected, you should consult the financial aid offices at your desired colleges and universities.

How to Maximize Need-Based Financial Aid

If you’re seeking to make college more affordable through need-based financial aid, there are a few strategic steps to consider. Here are some ways through which you can set yourself up for better chances of securing need-based aid.

Submit the FAFSA Early

The Free Application for Federal Student Aid (FAFSA) is the most important document determining your eligibility for need-based aid. File it as early as possible, as some forms of aid are distributed on a first-come, first-served basis.

Provide Accurate Information

Ensure that the information you provide on your FAFSA is accurate and up-to-date. Mistakes or discrepancies can delay the processing of your application.

Meet Application Deadlines

Pay close attention to financial aid application deadlines at both, the federal and state levels. Missing these deadlines can limit your access to certain need-based aid programs.

Be Prepared for Verification

Some applicants are selected for verification, a process that requires additional documentation to confirm the accuracy of your FAFSA information. Be prepared to comply with any verification requests promptly.

Maintain Satisfactory Academic Progress

Many need-based aid programs require students to maintain Satisfactory Academic Progress (SAP) to remain eligible. Make sure you understand your institution’s SAP requirements and strive to meet them.

Seek Institutional Aid

Explore the financial aid programs offered by your college or university. Some institutions may have their own need-based scholarships and grants that can further supplement your aid package.

Exploring your financial aid options can be a time-consuming, effort-intensive, yet highly valuable process. The right opportunities could be just one essay away–but you’ll never know unless you actively seek them out.

Stay proactive, stay informed, and seek assistance from your school’s financial aid office to maximize your financial aid options.

To Sum Up

Understanding the “ins and outs” of financial aid is a step you must take before pursuing higher education. By understanding what need-based financial aid is, you can better navigate the path to your educational goals. Exploring your financial aid options is like doing your pre-college homework. It’s a proactive step that can significantly impact your college experience.

It’s never too early to start your research for financial aid opportunities that can make your college education more affordable.

Frequently Asked Questions (FAQs)

To increase your eligibility for need-based aid, aim to complete the Free Application for Federal Student Aid (FAFSA) accurately and submit it by the specified deadlines for your state. Maintain satisfactory academic progress and ensure that your application information is up-to-date. Additionally, explore institutional aid programs and scholarships offered by your college or university to maximize your financial support.

Yes, it’s possible to receive both types of financial aid. Merit-based financial aid recognizes your achievements and qualifications, while need-based aid addresses financial hardship. Many students qualify for a combination of both, depending on their unique circumstances and the policies of the institution offering the aid. Keep in mind that eligibility for need-based aid is often determined by the cost of attendance and the Expected Family Contribution (EFC), which can be impacted by other forms of financial assistance.

The impact of merit awards on need-based aid can vary depending on the institution’s financial aid policies. Some colleges use a “stacking” approach, where they may reduce need-based aid to prevent the total aid package from exceeding the cost of attendance. Others employ a “replacement” policy, ensuring that merit scholarships do not reduce need-based aid. You should consult your college’s financial aid office to understand how merit awards may affect your specific financial aid package.